Fintech, brief for “monetary know-how,” is likely one of the most fascinating know-how areas right now. Customers rely closely on fintech apps for actions as various as cell banking and on-line procuring. With an anticipated $10.52 trillion in digital transactions by 2025, the monetary know-how trade is rising at an exponential charge.

The event of recent fintech functions has not too long ago skyrocketed in reputation worldwide. Monetary establishments have been capable of pioneer ground-breaking makes use of of digital know-how due to the proliferation of smartphones.

In mild of the current uptick in funding and concentrate on the monetary sector, it’s essential to understand the elements that contribute to the success of fintech functions.

The IT trade is quickly adopting blockchain and digital currencies. Many industries could profit from blockchain-based applied sciences sooner or later. Quite a few sectors, comparable to healthcare, insurance coverage, actual property, and banking, are included right here.

“Fintech” refers to an app that provides monetary providers to its customers by way of the mixing of economic applied sciences. Extra sources have been allotted in recent times to the creation of fintech packages. In the event you’re contemplating making an app for monetary know-how, you need to know what’s concerned. Try these varied apps and discuss what makes them distinctive.

As a class, fintech apps are distinguished by their intensive use of state-of-the-art options and instruments. The next are probably the most important items of know-how to contemplate when making a fintech funds app.

To place it in context, AI just isn’t a brand new idea. Nonetheless, solely not too long ago, due to developments in knowledge assortment and processing know-how, have fintech corporations began utilizing it. Machine studying is likely one of the many subfields of synthetic intelligence (AI). The sector of synthetic intelligence, generally known as machine studying, permits computer systems to be taught new abilities and information from knowledge with out being informed what to search for.

A method through which blockchain know-how is reshaping the monetary sector is by altering the means by which info is saved, transacted, and transmitted. Blockchain has no central level the place it may be attacked or compromised as a result of it’s decentralized and distributed throughout a number of nodes or areas. Having one thing that may’t be modified over time helps set up credibility in a enterprise relationship. Customers can solely entry their very own encrypted knowledge reasonably than all the database. All transactions are verified via community consensus earlier than being added to the chain, making it tough for identification thieves to steal anybody’s private info.

On-line banking, digital fee methods, and chatbots are simply a number of the fintech improvements which have emerged in recent times. Chatbots are AI-enabled software program packages that may simulate human dialog with on-line customers in real-time. This speedy ascent in reputation can largely be attributed to chatbots’ superior potential to deal with customer support inquiries. They will also be utilized in many environments.

“Gamification” describes the method by which software program is made to perform extra like a recreation. This demonstrates that, underneath the appropriate circumstances, folks may be motivated by factors, achievements, and leaderboards. Using gamification is a method that may support software program improvement corporations in reaching their objectives by growing buyer involvement with their choices. More often than not, it’s utilized in monetary know-how.

Mix “monetary” with “know-how,” and also you get the time period “monetary know-how.” “fintech” is brief for “monetary know-how,” and it encompasses something that helps folks or companies conduct monetary transactions on-line or achieve digital entry to monetary knowledge.

As digital instruments grew to become extra extensively utilized by shoppers over the previous decade, fintech emerged to assist folks handle their cash and progress towards their monetary objectives. In the meantime, shoppers have come to depend on fintech for a variety of makes use of, from banking and budgeting to investments and lending, along with the plain advantages it supplies in day-to-day life.

Monetary know-how, or “fintech,” encompasses a variety of software program used within the monetary providers trade, together with B2B, B2C, and P2P platforms. This text will have a look at only a few examples of fintech which can be inflicting waves within the banking and insurance coverage industries.

There have been main shifts within the banking sector, an important a part of the monetary system, resulting from developments in monetary know-how. For instance, Plaid’s Auth and Identification have made it simple and quick to open an account and deposit funds whereas decreasing the variety of fraudulent sign-ups. Alternatively, neo-banks like Present present clients with extra adaptable checking accounts, sooner processing of direct deposits, and even banking merchandise designed particularly for younger adults. Conventional charges, which might forestall folks from reaching their monetary objectives, will not be charged for any of those providers.

Lately, cashless transactions have gained reputation. For the reason that pandemic started, cashless funds have elevated dramatically, accounting for 31% of all funds within the US and 60% of all funds within the UK. On the identical time, there was a dramatic enlargement within the variety of payment-related apps and providers obtainable. It’s because it’s now a lot simpler and sooner to enroll and authenticate customers and since accepting funds by way of direct financial institution switch is less expensive than accepting funds by way of bank cards.

Apps designed for private monetary administration (PFM) make it a lot simpler for customers to remain updated on their monetary state of affairs by centralizing knowledge from a number of accounts in a single dashboard. An individual’s monetary state of affairs may be higher understood with the assistance of those providers, which support them in organizing their funds, making budgets, and so forth.

By using fintech options that assist them mixture knowledge from segregated accounts, monetary advisors and wealth administration platforms can enhance their belongings underneath administration (AUM) and higher serve their purchasers. As an illustration, Atom Finance provides its clients a set of instruments that collectively make it simpler to find out about and handle all of their investments in a single place. Stash is a subscription-based platform that offers customers simple, low-cost entry to varied funding, training, and monetary advice-related services.

As a result of it takes a lot effort and time to gather info on candidates’ incomes, account balances, and asset histories, lenders typically wrestle to acquire a whole and correct image of their candidates. Additionally, it may be a trouble to get debtors to hyperlink their financial institution accounts so that cash may be transferred and cash may be paid again.

Because of making the total vary of economic providers accessible to shoppers, fintech has carved out a large area of interest in folks’s day-to-day lives. Plaid discovered that 8 out of 10 individuals who use fintech providers report feeling like they match naturally into their routines.

What does the time period “Fintech” really check with? How May This Have an effect on Future Cost Strategies?

We use the time period “fintech” to explain the hybrid of cutting-edge know-how and traditional banking providers. Fintech, in different phrases, is the usage of know-how to streamline and velocity up the supply of economic providers.

Synthetic intelligence (AI), machine studying (ML), and blockchain are examples of cutting-edge applied sciences that will likely be used to automate and improve the supply of economic providers.

Cell banking, lending, buying and selling, and different monetary providers supplied by fintech corporations entice clients resulting from their comfort, safety, and scalability. Due partly to this, the monetary know-how trade has expanded.

Earlier than diving headfirst into the event of your monetary know-how software, it is advisable contemplate your goal market rigorously. Make investments a while in studying in regards to the performance of the app kind you plan to create.

Having a agency grasp on what’s legally permissible on this house is important earlier than committing to the options of your app.

It’s because most international locations have their very own distinctive set of legal guidelines and laws that have to be adopted. As well as, varied strategies of economic safety are employed by varied nations to trace adherence.

In the event you’ve gotten this far, you can begin enthusiastic about the right way to differentiate your fintech app from the competitors.

To realize this objective, you need to conduct intensive market analysis, together with analyzing and evaluating your opponents; analyzing the professionals and cons of their apps.

To attempt to discover points in competing for monetary app improvement and develop an concept for the app that can set you aside from the competitors by offering a greater answer to an issue.

Market analysis is full, and your app’s meant use is established. It’s time to resolve which monetary know-how options are crucial.

The time period “fintech” is an abbreviation for the broader trade that mixes monetary providers and technological innovation. You’ll be able to construct the reply you require by determining the right way to greatest pairing these two elements.

The know-how stack have to be rigorously thought of when making a fintech software. As a result of there may be a lot to pick from, you would possibly find yourself with the incorrect merchandise. And it might have some extraordinarily dire penalties.

Late within the software’s improvement, when funds are extra restricted, unexpected obstacles can come up resulting from inadequate sources.

You must put your app concept via its paces earlier than releasing a full-fledged monetary know-how answer. Because of this, a minimal viable product (MVP) model of the app is created.

Versus the previous actions, this one will proceed for the foreseeable future. Even after you’ve launched your fintech app, you need to maintain including new performance. As an alternative, improve and enhance it consistently as you obtain constructive criticism.

There was a whole upheaval within the monetary providers sector resulting from fintech, which has spawned a brand new multibillion-dollar sector. The monetary sector as a complete has grown at an exponential charge on account of this game-changing know-how permitting banks to supply modern new providers to their clients.

The price of making a monetary know-how app is difficult to estimate. The truth that each enterprise has its personal distinctive wants and objectives influences the entire value of constructing a FinTech app. Various elements, together with the character and scope of the app, its options, the placement of the app improvement firm, the app’s high quality of efficiency, and the size of time it took to create, all contribute to the ultimate price ticket.

A customized FinTech app that gives customers with a easy and safe means of creating on-line purchases might begin at a minimal of $40,000. One can be taught it in as little as three to 4 months. Alternatively, it might value between $30,000 and $50,000 to create a banking app with a comparatively fundamental interface and set of options.

A monetary app’s improvement prices can vary extensively, as talked about above, relying on the precise options and performance desired by the developer. The next desk supplies a tough estimate of the prices concerned in creating a number of the hottest FinTech apps at the moment in use, together with banking, lending, funding, private finance, and insurance coverage apps. Learn on to know extra about it.

Digital banking or web banking functions provide you with fast and easy accessibility to any and all monetary providers you would ever want. On-line providers have made it potential to do all kinds of duties, comparable to opening an account and making use of for a mortgage.

FinTech banking app improvement prices can fluctuate from $30,000 to $300,000, relying on the challenge’s diploma of complexity.

Progress within the P2P lending sector has been spectacular not too long ago. Within the close to future, due to the partnerships at the moment being fashioned by companies, clients will be capable of apply for loans (as much as a selected restrict) via digital channels. Regardless of the excessive stakes, the method of lending cash may be simplified.

Private finance apps have made it a lot less complicated for shoppers to maintain monitor of their cash. It’s potential for people to watch their monetary state of affairs, plan for the long run, and decide to dwelling inside their means by protecting a funds and sticking to their monetary plan. These packages function digital diaries, letting customers maintain monitor of and analyze their cash flows in real-time. Prices for the creation of a customized monetary app by a agency that focuses on the creation of FinTech apps for companies sometimes vary from $60,000 to $300,000.

Customers can use these apps to buy a variety of providers at a concession. Sooner or later, monetary establishments like mutual funds could present their purchasers with entry to such funding software program.

A rise in cell phone utilization has led to a increase in modern monetary providers for smartphones. Lately, the entire variety of cell transactions has skyrocketed. With the rise of neobanks and tremendous apps catering to digital funds, analysis signifies the worldwide progress of finance apps is on the cusp of an incredible enlargement. As the usage of digital fee strategies will increase, this progress is anticipated.

As of 2023, monetary establishments ought to strongly contemplate implementing the next options into their cell banking functions to maintain up with buyer preferences:

The initially requirement is an intuitive and easy-to-navigate consumer interface. Quite a few apps current customers with a jumbled expertise and poor instructions, prompting them to uninstall the apps in query. The app ought to make it simpler to get round by together with a search perform that can be utilized by typing in a question or utilizing the machine’s microphone to ask questions.

The flexibility to tailor the app to every particular person consumer is at the moment probably the most essential function. The youthful demographic is important, and this function could assist entice and retain them as clients. Take into account including dynamic digital assistants and customized insights throughout the app, adapting to every consumer’s spending habits and revenue.

The very best cell banking apps provide useful assist in a variety of alternative ways for his or her clients. Clients can have much less hassle getting in contact with the banks ought to they’ve any inquiries or issues.

Notifications and alerts are essential for protecting in contact with clients and selling providers which can be well-suited to their wants. If the alerts pop up too typically or are too insistent, clients could grow to be annoyed. There must be a method for customers to pick or set preferences for the categories, timing, and frequency of notifications they obtain.

After a meteoric rise within the variety of knowledge breaches, cyber thefts, and hackers, safety has emerged as probably the most essential trait to have. Clients will doubtless need assurance that their private info is secure with you. If apps on cell units can present the best degree of safety, then customers can use their units with out fear.

As well as, digital fee could rank highest on the record of priorities for many clients and is thus an indispensable function. On this cashless period, it’s crucial that every one cell banking apps present handy entry to quite a lot of digital fee options, together with cell wallets, UPI, and different comparable providers.

Because of the pandemic, fewer persons are keen to hold money and those that do are inclined to maintain as little as potential available. P2P funds, also called peer-to-peer funds, allow clients to ship and obtain financial transfers between themselves and different customers of the identical platform, sometimes by way of a cell software.

About 72% of Indian shoppers say that they’re hesitant to make use of digital functions and make digital funds resulting from an absence of fluency in English and normal discomfort with the web as limitations to doing so. With the rise of cell banking in underserved areas, it might be prudent to create an app with multilingual assist to make sure that the digital ecosystem is out there to all.

Personalizing your interactions with every buyer is essential if you wish to present them with a one-of-a-kind expertise when utilizing your services or products. Due to this, banks and credit score unions can now provide clients a customized account administration portal that may be tailor-made to their particular wants.

Regardless of its obvious simplicity, the ATM locator is an especially useful gizmo that the overwhelming majority of consumers require. Furthermore, it may be used to showcase customer support, an exercise that, with the assistance of VR, may be made much more fascinating.

Suppose you might have a well-designed cell banking app that features the above essential elements. In that case, one can find it a lot less complicated to draw new clients, keep ahead of the competitors, and supply an excellent expertise in your current clientele.

Transactions carried out on-line have grown in significance within the trendy enterprise world. Speedy progress is being made within the areas of on-line banking, funding web sites, and mortgage and different monetary transaction functions. In the intervening time, investing within the analysis and improvement of fintech software software program is each an important technique for monetary service suppliers and a extremely fascinating possibility for entrepreneurs.

When you’ve tracked down a agency that makes a speciality of the creation of fintech functions, it is advisable consider your challenge individually throughout the next phases:

This necessitates evaluating how lengthy it should take to implement every successive step, starting with the thought for the app.

That is probably the most essential stage in figuring out when an app will likely be created. Each the builders and the tip customers are given equal consideration. We support in defining the scope of the challenge and establishing baseline necessities at this section. It’s a three-week course of, provides or take.

Accumulating and analyzing details about the product, the trade as a complete, the competitors, and the audience is a crucial a part of this app improvement section.

Hybrid apps are internet apps constructed with cross-platform improvement frameworks like Flutter and React Native. An app developed particularly for a cell platform is named a “native app” (Goal-C, Swift, and Java for iOS apps and Kotlin for Android apps). As much as 80% of the entire time wanted to develop the app may be attributed to the invention section.

The UI package’s graphical consumer interface elements permit customers to reap the benefits of new capabilities. Checkboxes, menu bars, icons, and different useful UI components are all a part of the consumer interface package that makes up an software.

This step is important, however how lengthy do you estimate it should take you to create a monetary know-how app? This stage of design can take anyplace from forty to eighty hours to finish.

It’s powerful to offer an actual time-frame for growing a fintech app as a result of every challenge is exclusive and has its personal necessities. A few of these variables embody including new options or sources, comparable to modules, APIs, or exterior instruments and providers. One other factor that can have an effect on how lengthy it takes to make a product is how a lot it must be linked and built-in with different software program methods, comparable to legacy methods.

Final however not least, one of the crucial important concerns when planning bespoke software program improvement timelines is whether or not or not the group plans to make use of its personal in-house technical sources, rent builders from one other group, or rent a contract developer. Having your personal firm’s software program engineers work in your challenge has many benefits as a result of they have already got a deep familiarity along with your firm’s wants and the applied sciences that will likely be used to satisfy these wants.

You need to create a cell app, however it is advisable know the way app costs are established, proper? If that’s the case, then you definitely’ll positively discover plenty of useful knowledge right here. Prices fluctuate extensively relying on a variety of elements, and this text examines a number of the most essential ones, together with the kind of app being developed, the placement of the app’s improvement, and different complexities. Whenever you’re completed studying, you’ll have all the information it is advisable make the perfect choices potential for what you are promoting.

Roughly 6.6 billion folks all over the world at the moment use smartphones, making cell functions extraordinarily frequent. Given how fashionable they’re and the way worthwhile their enter is, ignoring them could be a mistake.

Nonetheless, figuring out how a lot it prices to create an app is the primary and most vital step. It’s one of many first issues individuals who have an concept for an app need to know after they come to us.

The phrase “tentative” is acceptable right here as a result of so many variables can have an effect on the ultimate value, together with the kind of software, its performance, its degree of complexity, the seller chosen, and the strategy taken throughout improvement.

A complete of seven variables affect the price of a cell app.

Constructing a easy app takes much less time and prices much less cash. Nonetheless, the money and time required to develop your cell app will rise if you wish to embody subtle cell app options.

If we assume a charge of $40 per hour, this part supplies a tough estimate of how a lot it prices to develop a cell app, damaged down by the varied options discovered within the typical app.

The first driver behind the variation in cell app improvement prices throughout areas is the various hourly charges charged by programmers. In comparison with the US, the UK, and Australia, costs in India and different elements of Japanese Europe are clearly far more affordable.

When in comparison with the going charge in these areas ($120-$150/hour), the fee to create an app is considerably decrease.

In the event you assume the money and time spent on making a cell app has nothing to do with the strategy taken to its creation, you’d be incorrect. One should at all times maintain the event technique in thoughts when making a cell app.

Consulting a freelancer seems to be probably the most economically wise possibility on the desk. Nonetheless, this comes at a value. Freelancers haven’t any loyalty or accountability to their employers. The correctness of the app’s development can’t be assured. Due to this, it’s endorsed to work with a agency that focuses on app improvement. Spend much less cash and have extra management over your cell app’s improvement by going this route as a substitute of hiring an inner group or native company.

There are lots of constructive outcomes that may end result from implementing FinTech. These outcomes vary from elevated effectivity and safety to raised accessibility and comfort for purchasers. An ever-growing physique of proof means that monetary know-how will likely be a big consider shaping the way forward for the monetary sector. Study in regards to the cutting-edge improvements in FinTech and the way they may help your organization forward of the competitors. Discovering a dependable app improvement associate may be difficult. There’s lots to contemplate, and it may be difficult to maintain every little thing straight. In the event you’re having hassle growing a safe, scalable cell app inside your funds, Internet Options may help.

Final however not least, the openness of fintech apps wins over clients and retains them as common customers. Massive knowledge and open banking give common customers the instruments they should collect and analyze the information that can assist them make the perfect choices. The monetary sector has responded swiftly to the brand new realities necessitated by fintech’s proliferation. To maintain up, even long-standing corporations must experiment with recent approaches. Some research estimate that by 2030, the monetary know-how trade’s annual income can have doubled from its present ranges within the billions of {dollars}. By fusing cutting-edge technological developments with functions or monetary providers, monetary know-how has helped companies, particularly start-ups, disrupt a beforehand dominant trade and, in consequence, provide superior monetary providers to their clients. Within the subsequent a part of this text, we’ll take a better have a look at monetary know-how.

They’re chargeable for about 40% of annual improvement prices.

The significance of fintech within the enterprise world is outlined by each motion, regardless of how small. You must know that the value of creating a cell app can vary from $20,000 to $60,000, however the common value is $35000.

The monetary know-how trade is booming with innovation, and new concepts are consistently being formed into app codecs. As time goes on, the importance, usefulness, and necessity of economic know-how grow to be extra clear. Feeling overwhelmed by all the brand new monetary phrases, from cryptocurrencies like Ethereum and Bitcoin to non-fungible tokens (NFTs), is regular. You aren’t alone. Fixed innovation within the type of new specialised monetary software program options has been driving the quickly rising discipline of fintech.

Attributable to speedy technological development and reducing prices related to the event of economic know-how functions, the potential for additional disruption within the monetary know-how trade is sort of substantial. By 2030, the monetary know-how market is predicted to be price $699.50 billion, and the variety of clients utilizing digital banking providers is projected to rise from $197 million in 2021 to $217 million in 2025. The price of updating a FinTech software with the most recent applied sciences and most cutting-edge options is predicted to be between $60,000 and $100,000. As much as $250,000 could also be wanted to course of a really complicated monetary software.

In the event you want a monetary know-how app, go no additional than The App Concepts. We assure the best high quality service in your fintech app. Our group of builders is comprised of trade veterans, and they’re dedicated to offering you with the best potential lie-detection software program answer on the most reasonably priced value.

So go for it now!

Chirag Panchal is a Founding father of The App Concepts, a number one internet and cell app improvement firm specialised in android and iOS app improvement. He has experience in varied facets of enterprise like challenge planning, gross sales, advertising and marketing and has efficiently outlined flawless enterprise fashions for the purchasers Delivering greatest options to its native and international purchasers results in higher enterprise throughout.

When Is it Time for You to personal a FinTech app?

The event of recent fintech functions has not too long ago skyrocketed in reputation worldwide. Monetary establishments have been capable of pioneer ground-breaking makes use of of digital know-how due to the proliferation of smartphones.

In mild of the current uptick in funding and concentrate on the monetary sector, it’s essential to understand the elements that contribute to the success of fintech functions.

What Makes it a Grand concept for Funding?

The IT trade is quickly adopting blockchain and digital currencies. Many industries could profit from blockchain-based applied sciences sooner or later. Quite a few sectors, comparable to healthcare, insurance coverage, actual property, and banking, are included right here.

“Fintech” refers to an app that provides monetary providers to its customers by way of the mixing of economic applied sciences. Extra sources have been allotted in recent times to the creation of fintech packages. In the event you’re contemplating making an app for monetary know-how, you need to know what’s concerned. Try these varied apps and discuss what makes them distinctive.

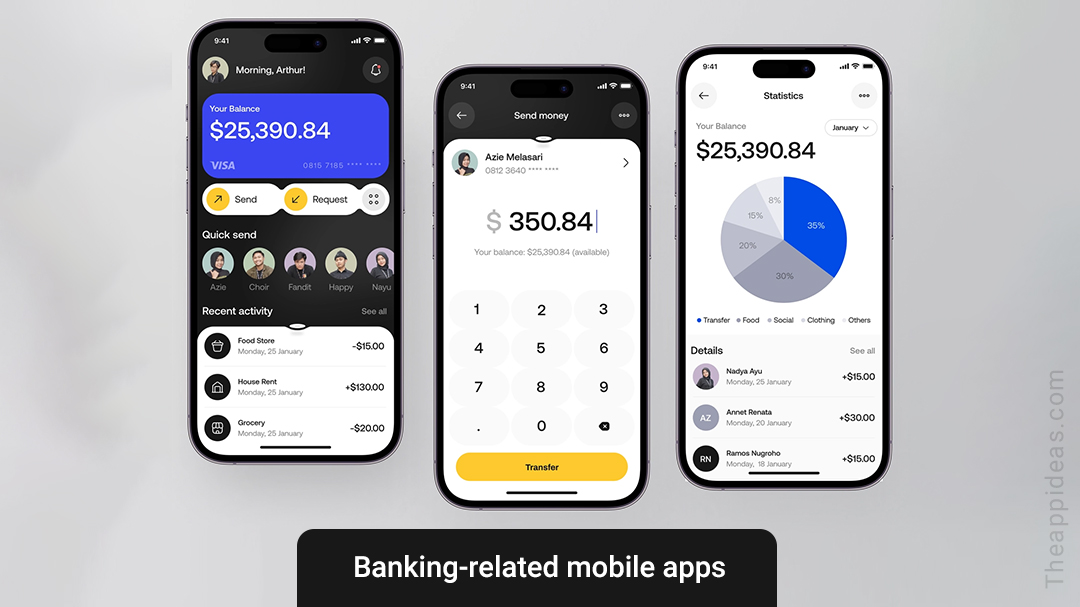

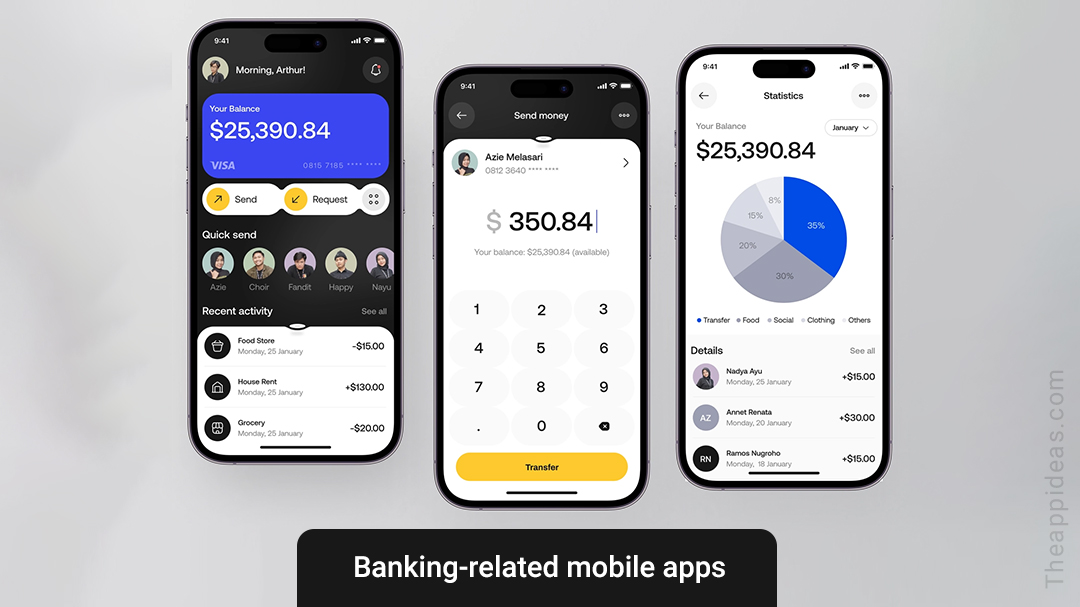

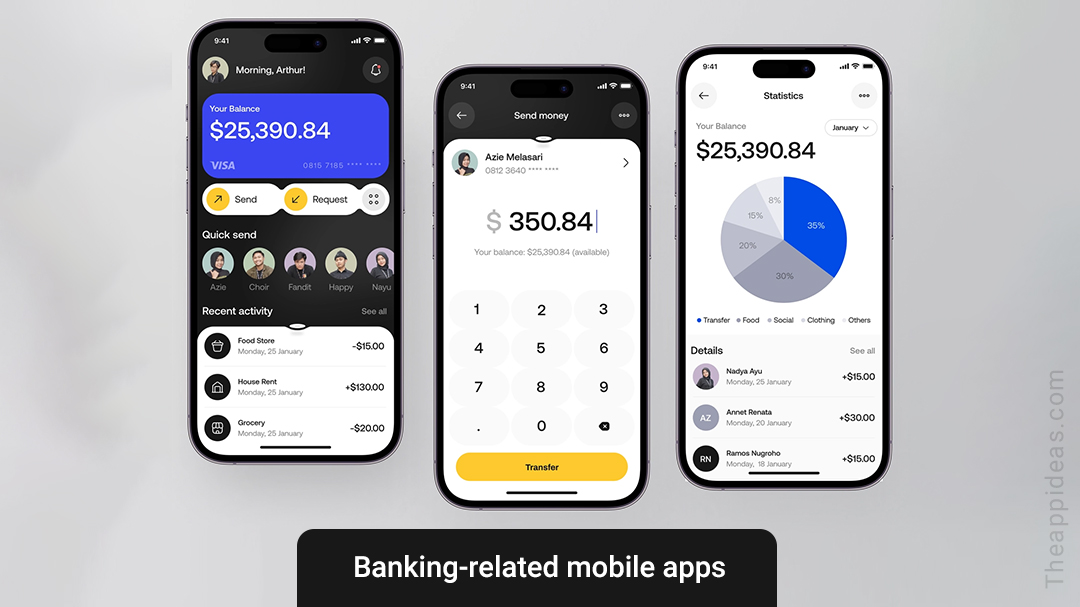

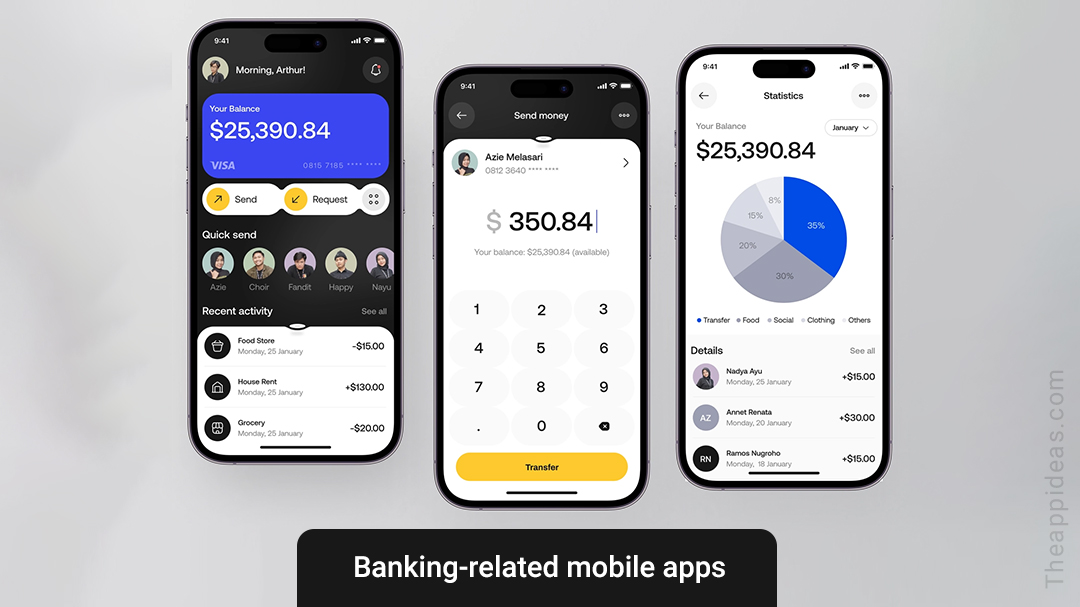

Applied sciences central to the creation of banking-related cell apps

As a class, fintech apps are distinguished by their intensive use of state-of-the-art options and instruments. The next are probably the most important items of know-how to contemplate when making a fintech funds app.

Software of Machine Studying and Synthetic Intelligence

To place it in context, AI just isn’t a brand new idea. Nonetheless, solely not too long ago, due to developments in knowledge assortment and processing know-how, have fintech corporations began utilizing it. Machine studying is likely one of the many subfields of synthetic intelligence (AI). The sector of synthetic intelligence, generally known as machine studying, permits computer systems to be taught new abilities and information from knowledge with out being informed what to search for.

Blockchain

A method through which blockchain know-how is reshaping the monetary sector is by altering the means by which info is saved, transacted, and transmitted. Blockchain has no central level the place it may be attacked or compromised as a result of it’s decentralized and distributed throughout a number of nodes or areas. Having one thing that may’t be modified over time helps set up credibility in a enterprise relationship. Customers can solely entry their very own encrypted knowledge reasonably than all the database. All transactions are verified via community consensus earlier than being added to the chain, making it tough for identification thieves to steal anybody’s private info.

Chatbots

On-line banking, digital fee methods, and chatbots are simply a number of the fintech improvements which have emerged in recent times. Chatbots are AI-enabled software program packages that may simulate human dialog with on-line customers in real-time. This speedy ascent in reputation can largely be attributed to chatbots’ superior potential to deal with customer support inquiries. They will also be utilized in many environments.

Gamification

“Gamification” describes the method by which software program is made to perform extra like a recreation. This demonstrates that, underneath the appropriate circumstances, folks may be motivated by factors, achievements, and leaderboards. Using gamification is a method that may support software program improvement corporations in reaching their objectives by growing buyer involvement with their choices. More often than not, it’s utilized in monetary know-how.

FinTech Software Sorts: A Temporary

Mix “monetary” with “know-how,” and also you get the time period “monetary know-how.” “fintech” is brief for “monetary know-how,” and it encompasses something that helps folks or companies conduct monetary transactions on-line or achieve digital entry to monetary knowledge.

As digital instruments grew to become extra extensively utilized by shoppers over the previous decade, fintech emerged to assist folks handle their cash and progress towards their monetary objectives. In the meantime, shoppers have come to depend on fintech for a variety of makes use of, from banking and budgeting to investments and lending, along with the plain advantages it supplies in day-to-day life.

The numerous shapes of Fintech

Monetary know-how, or “fintech,” encompasses a variety of software program used within the monetary providers trade, together with B2B, B2C, and P2P platforms. This text will have a look at only a few examples of fintech which can be inflicting waves within the banking and insurance coverage industries.

There have been main shifts within the banking sector, an important a part of the monetary system, resulting from developments in monetary know-how. For instance, Plaid’s Auth and Identification have made it simple and quick to open an account and deposit funds whereas decreasing the variety of fraudulent sign-ups. Alternatively, neo-banks like Present present clients with extra adaptable checking accounts, sooner processing of direct deposits, and even banking merchandise designed particularly for younger adults. Conventional charges, which might forestall folks from reaching their monetary objectives, will not be charged for any of those providers.

Funds

Lately, cashless transactions have gained reputation. For the reason that pandemic started, cashless funds have elevated dramatically, accounting for 31% of all funds within the US and 60% of all funds within the UK. On the identical time, there was a dramatic enlargement within the variety of payment-related apps and providers obtainable. It’s because it’s now a lot simpler and sooner to enroll and authenticate customers and since accepting funds by way of direct financial institution switch is less expensive than accepting funds by way of bank cards.

Apps designed for private monetary administration (PFM) make it a lot simpler for customers to remain updated on their monetary state of affairs by centralizing knowledge from a number of accounts in a single dashboard. An individual’s monetary state of affairs may be higher understood with the assistance of those providers, which support them in organizing their funds, making budgets, and so forth.

Wealth

By using fintech options that assist them mixture knowledge from segregated accounts, monetary advisors and wealth administration platforms can enhance their belongings underneath administration (AUM) and higher serve their purchasers. As an illustration, Atom Finance provides its clients a set of instruments that collectively make it simpler to find out about and handle all of their investments in a single place. Stash is a subscription-based platform that offers customers simple, low-cost entry to varied funding, training, and monetary advice-related services.

Lending

As a result of it takes a lot effort and time to gather info on candidates’ incomes, account balances, and asset histories, lenders typically wrestle to acquire a whole and correct image of their candidates. Additionally, it may be a trouble to get debtors to hyperlink their financial institution accounts so that cash may be transferred and cash may be paid again.

Elements of Monetary Know-how’s Impression

Because of making the total vary of economic providers accessible to shoppers, fintech has carved out a large area of interest in folks’s day-to-day lives. Plaid discovered that 8 out of 10 individuals who use fintech providers report feeling like they match naturally into their routines.

FinTech App Growth Steering You Would Want

What does the time period “Fintech” really check with? How May This Have an effect on Future Cost Strategies?

We use the time period “fintech” to explain the hybrid of cutting-edge know-how and traditional banking providers. Fintech, in different phrases, is the usage of know-how to streamline and velocity up the supply of economic providers.

Synthetic intelligence (AI), machine studying (ML), and blockchain are examples of cutting-edge applied sciences that will likely be used to automate and improve the supply of economic providers.

Cell banking, lending, buying and selling, and different monetary providers supplied by fintech corporations entice clients resulting from their comfort, safety, and scalability. Due partly to this, the monetary know-how trade has expanded.

- You must determine who you need to promote to

Earlier than diving headfirst into the event of your monetary know-how software, it is advisable contemplate your goal market rigorously. Make investments a while in studying in regards to the performance of the app kind you plan to create.

Having a agency grasp on what’s legally permissible on this house is important earlier than committing to the options of your app.

Authorized certainty is important for the fintech answer you plan to develop

It’s because most international locations have their very own distinctive set of legal guidelines and laws that have to be adopted. As well as, varied strategies of economic safety are employed by varied nations to trace adherence.

- Figuring out your aggressive edge.

In the event you’ve gotten this far, you can begin enthusiastic about the right way to differentiate your fintech app from the competitors.

To realize this objective, you need to conduct intensive market analysis, together with analyzing and evaluating your opponents; analyzing the professionals and cons of their apps.

To attempt to discover points in competing for monetary app improvement and develop an concept for the app that can set you aside from the competitors by offering a greater answer to an issue.

- Within the fourth stage, you’ll outline the required capabilities

Market analysis is full, and your app’s meant use is established. It’s time to resolve which monetary know-how options are crucial.

- Collect a succesful group of individuals to work on the issue

The time period “fintech” is an abbreviation for the broader trade that mixes monetary providers and technological innovation. You’ll be able to construct the reply you require by determining the right way to greatest pairing these two elements.

- You’ll select the know-how stack that’s best for you

The know-how stack have to be rigorously thought of when making a fintech software. As a result of there may be a lot to pick from, you would possibly find yourself with the incorrect merchandise. And it might have some extraordinarily dire penalties.

- Creating a value estimate is the seventh stage

Late within the software’s improvement, when funds are extra restricted, unexpected obstacles can come up resulting from inadequate sources.

- Construct a Minimal Marketable Product

You must put your app concept via its paces earlier than releasing a full-fledged monetary know-how answer. Because of this, a minimal viable product (MVP) model of the app is created.

- Construct, repair up, and polish

Versus the previous actions, this one will proceed for the foreseeable future. Even after you’ve launched your fintech app, you need to maintain including new performance. As an alternative, improve and enhance it consistently as you obtain constructive criticism.

Elements Influencing the Value of Creating a FinTech App

There was a whole upheaval within the monetary providers sector resulting from fintech, which has spawned a brand new multibillion-dollar sector. The monetary sector as a complete has grown at an exponential charge on account of this game-changing know-how permitting banks to supply modern new providers to their clients.

How a lot house will you want in your funds to develop a fintech app?

The price of making a monetary know-how app is difficult to estimate. The truth that each enterprise has its personal distinctive wants and objectives influences the entire value of constructing a FinTech app. Various elements, together with the character and scope of the app, its options, the placement of the app improvement firm, the app’s high quality of efficiency, and the size of time it took to create, all contribute to the ultimate price ticket.

A customized FinTech app that gives customers with a easy and safe means of creating on-line purchases might begin at a minimal of $40,000. One can be taught it in as little as three to 4 months. Alternatively, it might value between $30,000 and $50,000 to create a banking app with a comparatively fundamental interface and set of options.

Prices and Advantages of Numerous Monetary Know-how Functions

A monetary app’s improvement prices can vary extensively, as talked about above, relying on the precise options and performance desired by the developer. The next desk supplies a tough estimate of the prices concerned in creating a number of the hottest FinTech apps at the moment in use, together with banking, lending, funding, private finance, and insurance coverage apps. Learn on to know extra about it.

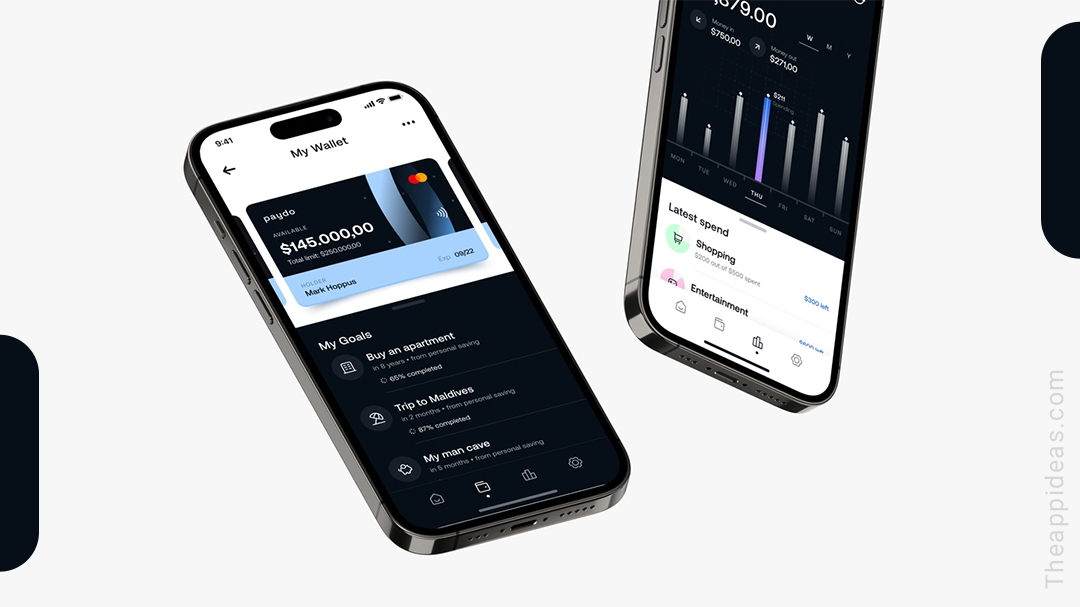

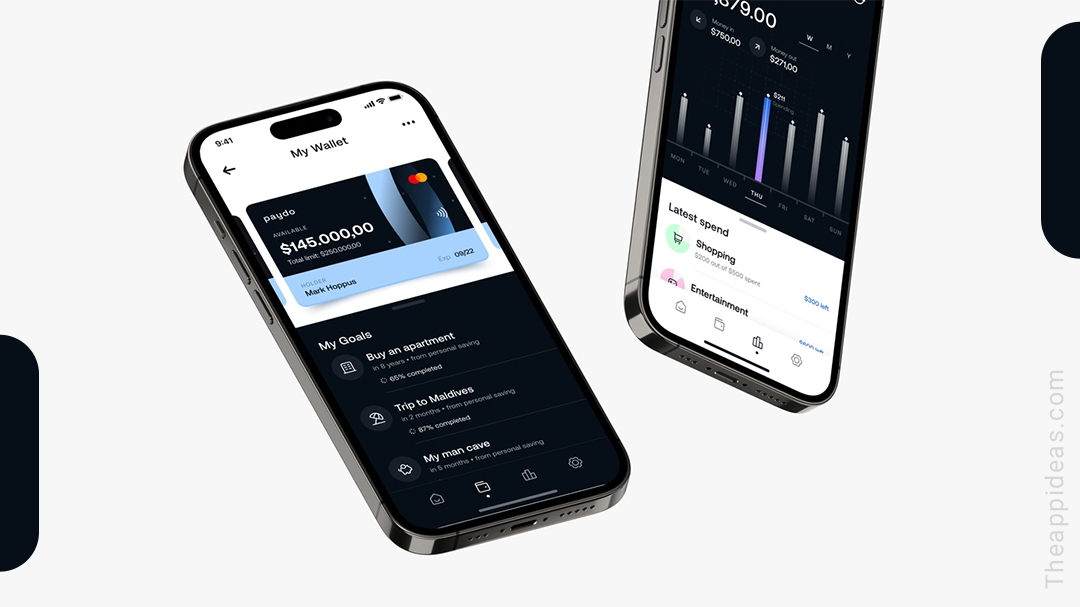

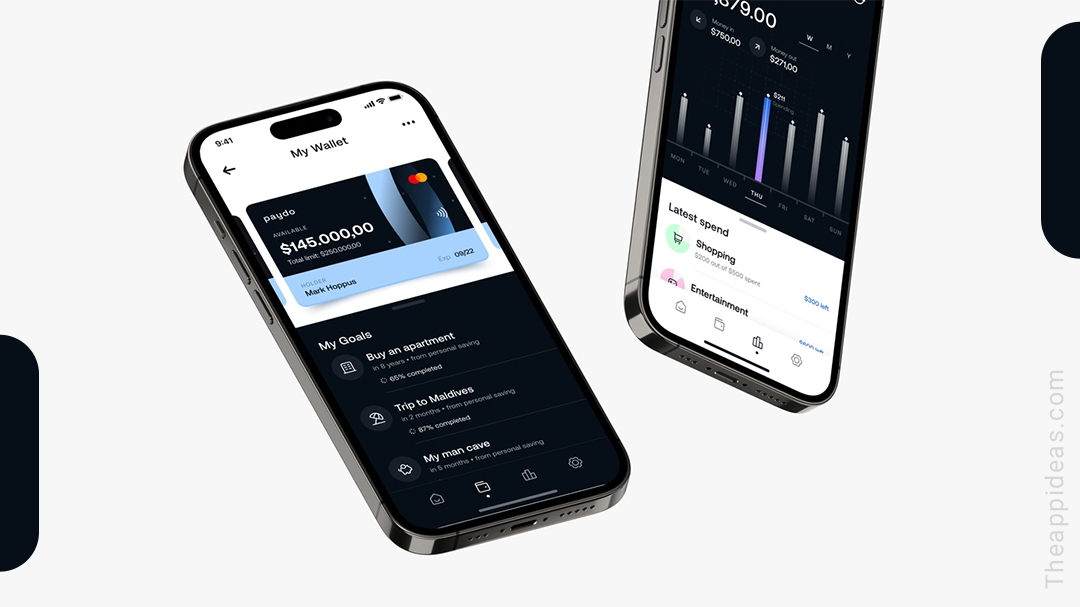

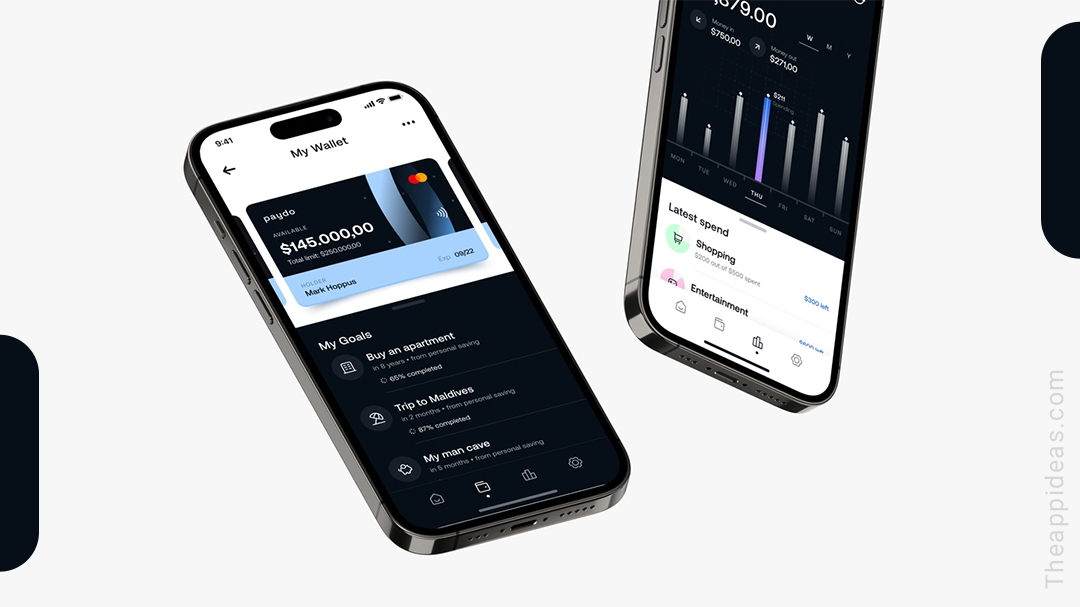

Cell Cash Administration Functions

Digital banking or web banking functions provide you with fast and easy accessibility to any and all monetary providers you would ever want. On-line providers have made it potential to do all kinds of duties, comparable to opening an account and making use of for a mortgage.

FinTech banking app improvement prices can fluctuate from $30,000 to $300,000, relying on the challenge’s diploma of complexity.

Loaning Software Software program

Progress within the P2P lending sector has been spectacular not too long ago. Within the close to future, due to the partnerships at the moment being fashioned by companies, clients will be capable of apply for loans (as much as a selected restrict) via digital channels. Regardless of the excessive stakes, the method of lending cash may be simplified.

Use Instances in Particular person Funds

Private finance apps have made it a lot less complicated for shoppers to maintain monitor of their cash. It’s potential for people to watch their monetary state of affairs, plan for the long run, and decide to dwelling inside their means by protecting a funds and sticking to their monetary plan. These packages function digital diaries, letting customers maintain monitor of and analyze their cash flows in real-time. Prices for the creation of a customized monetary app by a agency that focuses on the creation of FinTech apps for companies sometimes vary from $60,000 to $300,000.

Monetary Apps

Customers can use these apps to buy a variety of providers at a concession. Sooner or later, monetary establishments like mutual funds could present their purchasers with entry to such funding software program.

Options in your Fintech App

A rise in cell phone utilization has led to a increase in modern monetary providers for smartphones. Lately, the entire variety of cell transactions has skyrocketed. With the rise of neobanks and tremendous apps catering to digital funds, analysis signifies the worldwide progress of finance apps is on the cusp of an incredible enlargement. As the usage of digital fee strategies will increase, this progress is anticipated.

As of 2023, monetary establishments ought to strongly contemplate implementing the next options into their cell banking functions to maintain up with buyer preferences:

A streamlined structure and simple navigation

The initially requirement is an intuitive and easy-to-navigate consumer interface. Quite a few apps current customers with a jumbled expertise and poor instructions, prompting them to uninstall the apps in query. The app ought to make it simpler to get round by together with a search perform that can be utilized by typing in a question or utilizing the machine’s microphone to ask questions.

An Adaptive and Custom-made Journey

The flexibility to tailor the app to every particular person consumer is at the moment probably the most essential function. The youthful demographic is important, and this function could assist entice and retain them as clients. Take into account including dynamic digital assistants and customized insights throughout the app, adapting to every consumer’s spending habits and revenue.

Replacements for Buyer Assist

The very best cell banking apps provide useful assist in a variety of alternative ways for his or her clients. Clients can have much less hassle getting in contact with the banks ought to they’ve any inquiries or issues.

Communications (Textual content, Electronic mail, and so on.)

Notifications and alerts are essential for protecting in contact with clients and selling providers which can be well-suited to their wants. If the alerts pop up too typically or are too insistent, clients could grow to be annoyed. There must be a method for customers to pick or set preferences for the categories, timing, and frequency of notifications they obtain.

Improved Login Safety, Improved Password Insurance policies

After a meteoric rise within the variety of knowledge breaches, cyber thefts, and hackers, safety has emerged as probably the most essential trait to have. Clients will doubtless need assurance that their private info is secure with you. If apps on cell units can present the best degree of safety, then customers can use their units with out fear.

Digital Cash Transfers

As well as, digital fee could rank highest on the record of priorities for many clients and is thus an indispensable function. On this cashless period, it’s crucial that every one cell banking apps present handy entry to quite a lot of digital fee options, together with cell wallets, UPI, and different comparable providers.

Inter-Peer Switch of Funds

Because of the pandemic, fewer persons are keen to hold money and those that do are inclined to maintain as little as potential available. P2P funds, also called peer-to-peer funds, allow clients to ship and obtain financial transfers between themselves and different customers of the identical platform, sometimes by way of a cell software.

Language Choice across the World

About 72% of Indian shoppers say that they’re hesitant to make use of digital functions and make digital funds resulting from an absence of fluency in English and normal discomfort with the web as limitations to doing so. With the rise of cell banking in underserved areas, it might be prudent to create an app with multilingual assist to make sure that the digital ecosystem is out there to all.

Administration of Accounts

Personalizing your interactions with every buyer is essential if you wish to present them with a one-of-a-kind expertise when utilizing your services or products. Due to this, banks and credit score unions can now provide clients a customized account administration portal that may be tailor-made to their particular wants.

Finder of ATMs

Regardless of its obvious simplicity, the ATM locator is an especially useful gizmo that the overwhelming majority of consumers require. Furthermore, it may be used to showcase customer support, an exercise that, with the assistance of VR, may be made much more fascinating.

Suppose you might have a well-designed cell banking app that features the above essential elements. In that case, one can find it a lot less complicated to draw new clients, keep ahead of the competitors, and supply an excellent expertise in your current clientele.

Time Required for FinTech Cell App Growth

Transactions carried out on-line have grown in significance within the trendy enterprise world. Speedy progress is being made within the areas of on-line banking, funding web sites, and mortgage and different monetary transaction functions. In the intervening time, investing within the analysis and improvement of fintech software software program is each an important technique for monetary service suppliers and a extremely fascinating possibility for entrepreneurs.

Time required for every section of making a fintech app’s improvement cycle

When you’ve tracked down a agency that makes a speciality of the creation of fintech functions, it is advisable consider your challenge individually throughout the next phases:

Preparation Design Creation and Analysis

This necessitates evaluating how lengthy it should take to implement every successive step, starting with the thought for the app.

Stage One: Preparation

That is probably the most essential stage in figuring out when an app will likely be created. Each the builders and the tip customers are given equal consideration. We support in defining the scope of the challenge and establishing baseline necessities at this section. It’s a three-week course of, provides or take.

Accumulating and analyzing details about the product, the trade as a complete, the competitors, and the audience is a crucial a part of this app improvement section.

Hybrid apps are internet apps constructed with cross-platform improvement frameworks like Flutter and React Native. An app developed particularly for a cell platform is named a “native app” (Goal-C, Swift, and Java for iOS apps and Kotlin for Android apps). As much as 80% of the entire time wanted to develop the app may be attributed to the invention section.

UI Equipment

The UI package’s graphical consumer interface elements permit customers to reap the benefits of new capabilities. Checkboxes, menu bars, icons, and different useful UI components are all a part of the consumer interface package that makes up an software.

This step is important, however how lengthy do you estimate it should take you to create a monetary know-how app? This stage of design can take anyplace from forty to eighty hours to finish.

It’s powerful to offer an actual time-frame for growing a fintech app as a result of every challenge is exclusive and has its personal necessities. A few of these variables embody including new options or sources, comparable to modules, APIs, or exterior instruments and providers. One other factor that can have an effect on how lengthy it takes to make a product is how a lot it must be linked and built-in with different software program methods, comparable to legacy methods.

There are plenty of leeways in terms of timeliness supplied by your companion

Final however not least, one of the crucial important concerns when planning bespoke software program improvement timelines is whether or not or not the group plans to make use of its personal in-house technical sources, rent builders from one other group, or rent a contract developer. Having your personal firm’s software program engineers work in your challenge has many benefits as a result of they have already got a deep familiarity along with your firm’s wants and the applied sciences that will likely be used to satisfy these wants.

Estimated Value to develop an app

You need to create a cell app, however it is advisable know the way app costs are established, proper? If that’s the case, then you definitely’ll positively discover plenty of useful knowledge right here. Prices fluctuate extensively relying on a variety of elements, and this text examines a number of the most essential ones, together with the kind of app being developed, the placement of the app’s improvement, and different complexities. Whenever you’re completed studying, you’ll have all the information it is advisable make the perfect choices potential for what you are promoting.

Roughly 6.6 billion folks all over the world at the moment use smartphones, making cell functions extraordinarily frequent. Given how fashionable they’re and the way worthwhile their enter is, ignoring them could be a mistake.

Nonetheless, figuring out how a lot it prices to create an app is the primary and most vital step. It’s one of many first issues individuals who have an concept for an app need to know after they come to us.

The phrase “tentative” is acceptable right here as a result of so many variables can have an effect on the ultimate value, together with the kind of software, its performance, its degree of complexity, the seller chosen, and the strategy taken throughout improvement.

A complete of seven variables affect the price of a cell app.

The complexities of creating cell apps

Constructing a easy app takes much less time and prices much less cash. Nonetheless, the money and time required to develop your cell app will rise if you wish to embody subtle cell app options.

Preliminary value estimates for a variety of essential elements

If we assume a charge of $40 per hour, this part supplies a tough estimate of how a lot it prices to develop a cell app, damaged down by the varied options discovered within the typical app.

Territories in Growth

The first driver behind the variation in cell app improvement prices throughout areas is the various hourly charges charged by programmers. In comparison with the US, the UK, and Australia, costs in India and different elements of Japanese Europe are clearly far more affordable.

When in comparison with the going charge in these areas ($120-$150/hour), the fee to create an app is considerably decrease.

Modalities for Progress

In the event you assume the money and time spent on making a cell app has nothing to do with the strategy taken to its creation, you’d be incorrect. One should at all times maintain the event technique in thoughts when making a cell app.

Consulting a freelancer seems to be probably the most economically wise possibility on the desk. Nonetheless, this comes at a value. Freelancers haven’t any loyalty or accountability to their employers. The correctness of the app’s development can’t be assured. Due to this, it’s endorsed to work with a agency that focuses on app improvement. Spend much less cash and have extra management over your cell app’s improvement by going this route as a substitute of hiring an inner group or native company.

There are lots of constructive outcomes that may end result from implementing FinTech. These outcomes vary from elevated effectivity and safety to raised accessibility and comfort for purchasers. An ever-growing physique of proof means that monetary know-how will likely be a big consider shaping the way forward for the monetary sector. Study in regards to the cutting-edge improvements in FinTech and the way they may help your organization forward of the competitors. Discovering a dependable app improvement associate may be difficult. There’s lots to contemplate, and it may be difficult to maintain every little thing straight. In the event you’re having hassle growing a safe, scalable cell app inside your funds, Internet Options may help.

Final however not least, the openness of fintech apps wins over clients and retains them as common customers. Massive knowledge and open banking give common customers the instruments they should collect and analyze the information that can assist them make the perfect choices. The monetary sector has responded swiftly to the brand new realities necessitated by fintech’s proliferation. To maintain up, even long-standing corporations must experiment with recent approaches. Some research estimate that by 2030, the monetary know-how trade’s annual income can have doubled from its present ranges within the billions of {dollars}. By fusing cutting-edge technological developments with functions or monetary providers, monetary know-how has helped companies, particularly start-ups, disrupt a beforehand dominant trade and, in consequence, provide superior monetary providers to their clients. Within the subsequent a part of this text, we’ll take a better have a look at monetary know-how.

Hidden bills related to utilizing cell apps Growth

The next are not-to-be-ignored prices are concerned in making a cell app:

- Integration charges for exterior providers are an instance of practical prices. Annual charges can vary from $6,000 to $80,000.

- Upkeep prices embody issues like fixing bugs, spreading updates, and masking server prices. These annual repairs bills common out to about 20% of an app’s preliminary improvement funds.

- App promotion prices are these you incur to achieve potential customers.

They’re chargeable for about 40% of annual improvement prices.

Options of the Fintech App Growth:

- Within the high spot are required specs and different stipulations.

- It might take a couple of weeks to write down and handle the specs. The next are some issues you need to embody in your transient when discussing the right way to develop a fintech software:

- Targets and benchmarks for assessing the challenge’s completion

- In an RFP (request for proposals), you’re basically asking potential distributors to submit bids in a selected value vary.

- Confidentiality Settlement

- Roughly the second supply date. Wireframes

- The earliest visible iterations of the product’s idea are tough sketches known as wireframes. It helps each clients and designers visualize the completed product precisely as you envisioned it.

So, Lastly, What’s the Value for Such Fintech Apps?

The significance of fintech within the enterprise world is outlined by each motion, regardless of how small. You must know that the value of creating a cell app can vary from $20,000 to $60,000, however the common value is $35000.

The monetary know-how trade is booming with innovation, and new concepts are consistently being formed into app codecs. As time goes on, the importance, usefulness, and necessity of economic know-how grow to be extra clear. Feeling overwhelmed by all the brand new monetary phrases, from cryptocurrencies like Ethereum and Bitcoin to non-fungible tokens (NFTs), is regular. You aren’t alone. Fixed innovation within the type of new specialised monetary software program options has been driving the quickly rising discipline of fintech.

Attributable to speedy technological development and reducing prices related to the event of economic know-how functions, the potential for additional disruption within the monetary know-how trade is sort of substantial. By 2030, the monetary know-how market is predicted to be price $699.50 billion, and the variety of clients utilizing digital banking providers is projected to rise from $197 million in 2021 to $217 million in 2025. The price of updating a FinTech software with the most recent applied sciences and most cutting-edge options is predicted to be between $60,000 and $100,000. As much as $250,000 could also be wanted to course of a really complicated monetary software.

In the event you want a monetary know-how app, go no additional than The App Concepts. We assure the best high quality service in your fintech app. Our group of builders is comprised of trade veterans, and they’re dedicated to offering you with the best potential lie-detection software program answer on the most reasonably priced value.

So go for it now!

WOULD YOU LIKE TO BUILD AN FINTECH APP?

WP Publish Creator

Written by Chirag Panchal

Chirag Panchal is a Founding father of The App Concepts, a number one internet and cell app improvement firm specialised in android and iOS app improvement. He has experience in varied facets of enterprise like challenge planning, gross sales, advertising and marketing and has efficiently outlined flawless enterprise fashions for the purchasers Delivering greatest options to its native and international purchasers results in higher enterprise throughout.